Jersey: Is it worth structuring an offshore company in the country?

Understand the advantages and disadvantages and what the ideal business profile is for operating in this territory

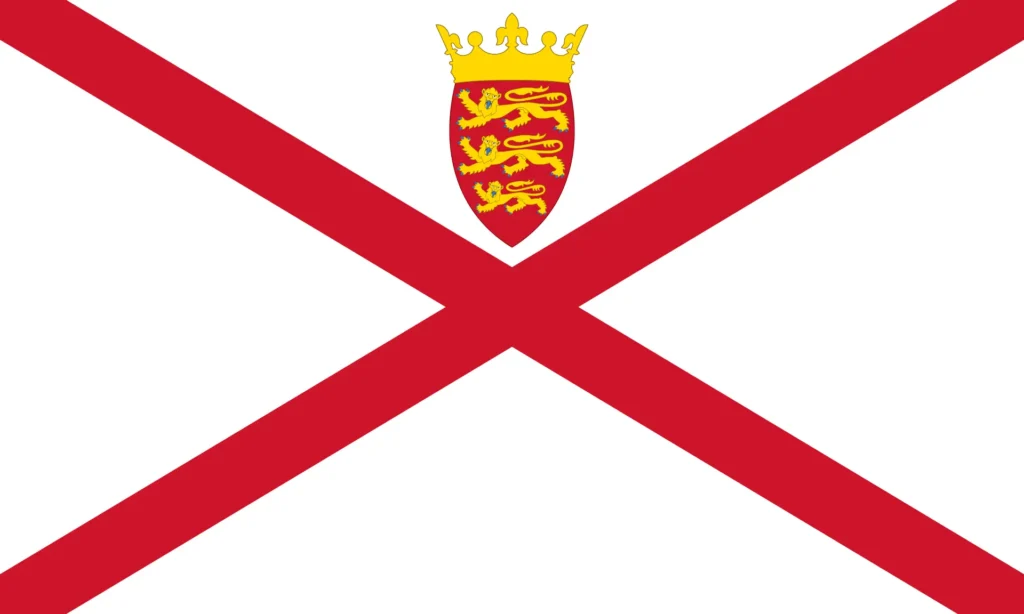

Jersey is an island country located in the English Channel, and is recognized in the business world as an offshore jurisdiction for having some crucial and beneficial characteristics for international companies operating in its territory. In addition to having a business environment that values transparency and compliance with international standards, Jersey has become a destination for offshore companies, which have turned to the country especially to establish investment structures and family businesses.

Its strategic location between the UK and mainland Europe provides companies with a favorable connection to the European and global markets, which has highlighted the country as a potential offshore destination. This is because Jersey offers a robust regulatory environment, economic and political stability, as well as a wide range of options for companies seeking tax efficiency and asset protection.

However, there are certain requirements for setting up in the country and, depending on the type and profile of business interested, Jersey can offer advantages and disadvantages. That’s why, in this article, we’re going to explore in detail the ideal business profile for operating on the island, as well as the steps needed to establish a successful operation in this jurisdiction.

Jersey and its advantageous tax structure for offshore companies

One of the main reasons that makes Jersey attractive to offshore companies is its flexible and advantageous tax regime. The island offers a specific tax system for international companies that allows them to operate at low rates or even be exempt in some situations. Below, we list the main points that characterize Jersey’s tax structure as advantageous for offshore companies:

- Corporate Tax Regime: Jersey companies have a simple and efficient tax structure, with a standard tax rate of 0% for most companies. However, financial institutions and some other categories, such as utilities, may be subject to a rate of 10% or 20%. This regime allows companies in specific sectors, such as investment and technology, to operate with a low tax burden, as long as they don’t carry out operations directly in Jersey;

- Tax exemption on dividends, profits and capital gains: One of Jersey’s most attractive features is the absence of taxes on dividends, capital gains and wealth transfers. This feature makes the island an excellent choice for private equity firms, asset management and other investment operations, benefiting companies planning to expand their investments and maximize their returns without the erosion of high taxes;

- Compliance with international standards: Jersey stands out among offshore jurisdictions for its policy of compliance with global regulations on transparency and combating tax evasion, such as the CRS (Common Reporting Standard) and FATCA (Foreign Account Tax Compliance Act). This feature contributes to the country’s good reputation and can be an important differentiator for companies seeking not only tax benefits, but also a base of operation with respect to international compliance;

Is Jersey good for your assets? Check out all the advantages and disadvantages

Jersey’s advantages as an offshore jurisdiction:

- Stability and reputation: Jersey has significant political stability and security, as the island is a dependency of the British Crown, which reinforces this characteristic. These points are advantageous attractions for international companies and investors looking to minimize risks in their investments;

- Compliance with international compliance standards: Compliance with transparency standards and global norms is a differentiator that strengthens Jersey’s reputation. This is especially important for companies that value a transparent approach and wish to avoid the restrictions imposed by jurisdictions with weaker regulations;

- Flexibility for complex corporate structures: Jersey allows companies to create sophisticated structures such as holding companies, trusts and foundations. These options are ideal for private equity firms, family wealth and investment funds, as they offer flexibility and privacy in the management of assets and investments;

- Support for asset protection structures: Companies and individuals can establish trusts and foundations to protect assets and optimize the transfer of wealth between generations. Jersey is widely used by private clients looking for a reliable jurisdiction to implement succession planning.

Jersey’s disadvantages as an offshore jurisdiction:

- Maintenance and Compliance costs: Maintaining a company in Jersey is more expensive compared to other offshore jurisdictions. Compliance, audit and annual registration fees are considerable, and this can be a disadvantage for companies looking for a lower-cost option;

- Strict regulation: Although Jersey has robust regulations that increase its credibility, it also imposes strict compliance requirements. This can be a disadvantage for companies looking for a jurisdiction with more flexible regulations and fewer compliance requirements.

Profile of the most suitable companies to set up in Jersey

Jersey as an offshore jurisdiction is an ideal country for companies that value both tax benefits and a reliable and highly transparent regulatory environment. Below, we list the main profiles of companies that manage to overcome the disadvantages and benefit from all the attributes that Jersey can offer.

Profile 1- Private equity firms and investment funds: Jersey stands out for its flexibility in allowing the formation of investment funds and private equity structures. Companies of this nature can take advantage of tax exemptions and the ease of creating trusts and limited partnerships, which are essential for large-scale asset management;

Profile 2- Wealth managers and family holdings: Jersey’s legal and tax structure makes it ideal for holding companies and wealth managers looking for asset protection and succession planning. The country allows the creation of foundations and trusts, which are widely used by families to protect assets from generation to generation;

Profile 3- Technology companies and global startups: Jersey’s environment also attracts technology companies looking for a base to expand in Europe, especially global startups with a digital business model. The absence of taxes on profits and the proximity to the European market make the island a strategic choice for digital companies;

Profile 4- Family offices and succession planning: High-income individuals and families who need structures to manage large assets often choose Jersey as an offshore jurisdiction. The country has a robust market for family office services, providing a secure and private environment for managing assets and inheritances.

How to structure a company in Jersey? Check out the step by step

The first step to setting up a company in Jersey is to understand the registration process and the different corporate structures available. This jurisdiction offers a flexible environment, allowing for both simple and complex structures, according to the needs and profile of the company and client.

This registration process is relatively straightforward in this territory, especially with the local support of professionals, such as lawyers and accountants, who are usually in charge of these procedures. The way the country has organized these steps facilitates compliance with regulatory requirements, which benefits interested companies.

Below you’ll find the main steps to opening your offshore company in Jersey:

- Choosing a company name: The company must select a name that is available and complies with the requirements of the Jersey Companies Registry. The availability check is one of the first steps to ensure that the desired name is not in use or registered in the country;

- Submit the necessary documents: Registration requires the submission of essential documents, such as the company’s Memorandum and Articles of Association, which detail its structure and business objectives. These documents need to be prepared in accordance with Jersey regulations;

- Appointment of directors and secretaries: Jersey requires companies to have nominee directors, who can be local or foreign. In some cases, it may be advisable to have directors resident in the island, depending on the type of activity;

- Offshore company registration in Jersey: The company must be officially registered, which includes paying an initial registration fee and obtaining the Certificate of Incorporation, which formalizes the company’s incorporation;

- Compliance with local requirements: In addition to initial registration, companies must meet compliance requirements, such as keeping accounting records and carrying out audits, depending on the size and nature of the company.

Types of corporate structures available in Jersey

Jersey offers a number of corporate structure options, which can cater for small businesses as well as large corporations and holding companies. The main structures include Limited Companies (LTD), Limited Liability Companies (LLCs), Limited Partnerships and trusts and foundations.

More specifically, Limited Companies (LTD) are the most common structures, ideal for commercial operations, investments and general business activities. Limited Liability Companies (LLCs) combine the flexibility of a partnership with the limited protection of a corporation. They are widely used for investment and holding purposes.

For their part, Limited Partnerships are a common choice for investment funds and capital partnerships and allow the creation of a partnership between general partners, who manage the entity, and limited partners who, as the nomenclature already mentions, have limited liability over the company. But Jersey is a jurisdiction that is really well known for trusts and foundations, for offering asset protection and is used for succession planning and managing the assets of high-income families and individuals.

What are the maintenance and operating costs of an offshore in Jersey?

To register and maintain a company in Jersey you will need to consider certain costs, including:

- Registration and licensing fees: Initial and annual registration fees, which vary according to the type and size of the company;

- Compliance and auditing: Offshore companies are obliged to meet compliance requirements, including submitting annual reports. Depending on the sector, an audit may be required, which increases operating costs;

- Professional services fees: It is common for companies to hire consultancy, accounting and legal services to ensure compliance with local laws.

Here’s how to maintain a successful operation in Jersey

Opening an operation in Jersey requires strategic planning and strict compliance with local regulations. Check out the main steps below to set up your international operation effectively:

Hiring Local Services

One of the first steps is to hire local consultancy and advisory services. Law and accounting firms specializing in company structuring in Jersey can help with documentation and ensure regulatory compliance during the process of implementing the operation. In addition, these firms facilitate the process of adapting to Jersey’s rules.

Management requirements and local board

The country allows international companies to be registered, but certain requirements must be met:

- Local directors: Although not mandatory for all types of business, having directors resident in Jersey can be advantageous in terms of regulatory compliance;

- Physical presence and registered office: Companies must have a physical address in Jersey, which is where all legal correspondence is received. This address also serves the purposes of transparency and communication with local authorities.

Compliance obligations and financial reporting

Jersey requires companies to keep up-to-date financial records and submit annual reports. Compliance obligations include:

- Financial reports and audits: Depending on the company’s size and type of activity, an annual financial audit may be mandatory. Small companies may have fewer requirements in this regard;

- Compliance with transparency standards: Jersey follows international transparency standards, and companies must meet reporting requirements such as the Common Reporting Standard (CRS) and FATCA. These requirements are essential to maintaining the jurisdiction’s good reputation.

Opening a corporate bank account in Jersey

Opening a bank account is a fundamental step for any company wishing to operate in the jurisdiction. This process can involve a rigorous compliance analysis, including:

- Bank selection: The country has both local and international banks that serve offshore companies. Local banks are regulated by the Jersey Financial Services Commission, ensuring reliability and security for companies;

- Documentation required: To open an account, companies must provide incorporation documents, identification of directors and shareholders and proof of address. In addition, it is common for banks to request a description of the company’s activities for compliance purposes.

Structure your company in a jurisdiction with an excellent international reputation

Jersey stands out as a robust and reliable offshore jurisdiction, offering tax benefits, structuring flexibility and an excellent international reputation. This jurisdiction is particularly suitable for companies that value compliance and stability, such as investment funds, family holding companies and technology companies with global operations. However, you need to be aware of maintenance costs and the strictness of regulatory obligations, which can be a challenging factor for some company profiles.

Jersey’s advantages, however, outweigh these challenges. We add the exemption from tax on profits, capital gains and the flexibility of complex structures as benefits that make the island an ideal choice for businesses looking to maximize asset protection and optimize their operations in an efficient and legal way. For companies and investors interested in a European base with credibility and security, Jersey is one of the best options.

And you can access this local market and benefit from all the advantages by structuring your offshore with TelliCoJus. Our professionals specializing in business internationalization will assist you in all phases of opening and establishing your offshore company in Jersey, as well as supporting you in drawing up your strategic planning and structuring in a respected and well-positioned jurisdiction.

Don’t miss the chance to join a network of entrepreneurs who are already reaping the rewards of the internationalization process. Contact us today and find out how TelliCoJus can help you write the next successful chapter in your business history.